Better banking with a Credit Union

We are Not-for-profit. Credit unions are structured to promote their members' financial wellness. Profits earned by the credit union are returned to our members in the form of reduced fees, higher savings interest rates, and lower loan rates.

We are Community-Oriented. A credit union serves a community of local members. As such, the credit union better understands the needs of its community than a large bank might. We support many local events and community causes, which means you have a part also!

Our Field of Membership and Member qualifications include:

Persons who live, work, worship, volunteer, or attend school in the Barren River Development District (BRADD) or Pennyrile Area Development District (PADD) areas of South Central and Western Kentucky area (which includes Allen, Barren, Butler, Caldwell, Christian, Crittenden, Edmonson, Hart, Hopkins, Livingston, Logan, Lyon, Metcalfe, Monroe, Muhlenberg, Simpson, Todd, Trigg, and Warren counties).

Directors, employees, volunteers, retirees, and members of businesses, associations, and other legal entities located within the BRADD or PADD.

Spouses of persons who passed away while within the field of membership of the Credit Union.

Current Service One Credit Union members.

Members of the immediate family or household of any of the above groups.

Read Our Quarterly Newsletters!

Our Vision

To be our community’s preferred financial partner.

Our Mission

To understand and meet our members’ and community’s needs to help them prosper.

Member owner

We are a financial cooperative, and you have a say in how we operate.

Management

| Name | Title |

|---|---|

| Rebecca Stone | Chief Executive Officer |

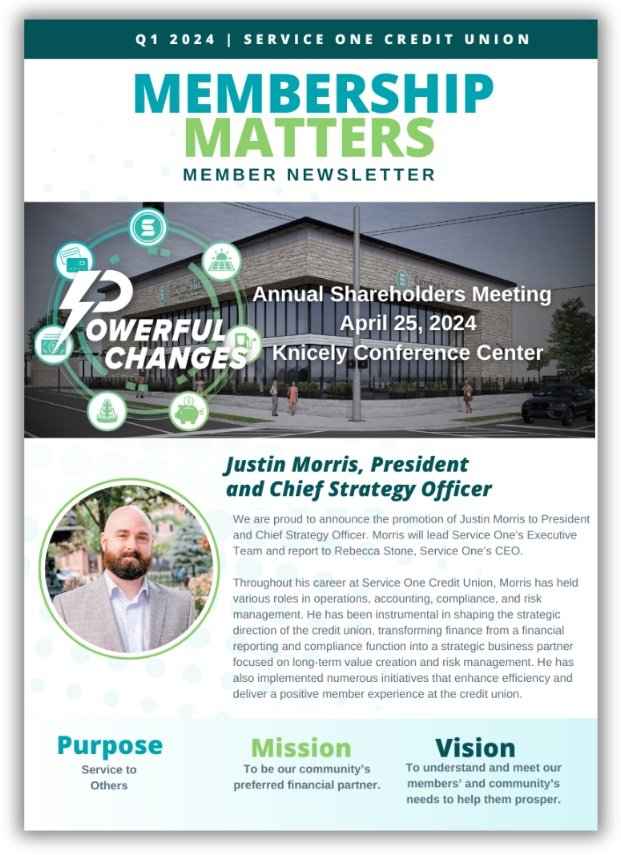

| Justin Morris, CPA | President, Chief Strategy Officer |

| Michelle Dyer | SVP, Chief Experience Officer |

| Rob Herrington | SVP, Chief Technology Officer |

| Brad Brown | SVP, Chief Operations Officer |

| Matt Hutcheson | SVP, Finance |

| Jenny Russell | VP, Member Solutions, Change Management |

| Jason Ross | VP, Member Engagement |

| Valerie Wilcox | VP, Strategic Finance/Controller |

| Nathan Dalrymple | VP, People & Compliance | Elisabeth Lindsey | VP, Member Experience |

| Jennifer Martin | AVP, Marketing, Advertising, and Communication |

| Greg Seaton | AVP, Asset Protection |

| RaeAnn Holmes | AVP, Talent & Development |

| Mindy Fabian | AVP, Loan Support |

| David Groce | Sr. Branch Manager - Glasgow |

| Paul Buhrmester | Branch Manager - Campus |

| Tammy Turner | Branch Manager - Bypass |

| Karen Knight | Branch Manager - Hopkinsville |

| Jonathan Turner | Branch Manager - Scottsville, Director of Wealth Management | Ralph Addison | Branch Manager - Russellville | Duncan Hines | Branch Manager - Campbell Lane |

| Susan Carder | Digital Branch Manager |

Board of Directors

As a not-for-profit financial institution, Service One is owned and operated by its members.

The Board of Directors, elected by the membership at the Annual Shareholders’ Meeting, serves as volunteers and determines the credit union’s direction.

| Name | Title |

|---|---|

| Dr. James McCaslin | Chair |

| J. Pat Stewart | Vice-Chair |

| Dr. Harold Little, Jr. | Secretary/Treasurer |

| Dr. Chris George | Director |

| Dr. Richard Miller | Director |

| Brenda Willoughby | Director |

| Dr. Brooke Justice | Director |

Supervisory Committee

The Supervisory Committee ensures that internal controls are maintained to protect the credit union and its members and that accounting records and reports are promptly prepared to accurately reflect credit union operations.

| Name | Title |

|---|---|

| Chris Royse | Chair |

| Jack Blaha | Member |

| Dr. Maggie Shelton | Member |

| Steve Winfrey | Member |

| Brian Becker | Member |

Our History

Our Journey

In 1963, a group of Western Kentucky University faculty and staff decided to help other people at WKU by loaning them money. The group determined a credit union was the best way to serve others. Western Kentucky State Credit Union was Incorporated and approved by the Department of Banking in January 1963. A merger with United Teachers Federal Credit Union in 1984 included employees of all educational institutions within the counties of Allen, Barren, Butler, Cumberland, Edmonson, Logan, Metcalfe, Monroe, Muhlenberg, Simson, Todd, and Warren counties. On February 28, 1992, approval was given by the Department of Financial Institutions to change the name from Western Kentucky State Credit Union to Service One Credit Union. Along with WKU employees, students and alumni, and Select Employee Groups, the change helped the credit union serve the Barren River Development District (B.R.A.D.D.) as a field of membership. November 2002, Service One merged with Bowling Green Federal Employees Federal Credit Union and added federal employees to Service One's field of membership in counties we currently serve (B.R.A.D.D.), plus Trigg and Christian counties. January 2012, individual membership eligibility was approved based upon the common bond of a person's daily activities, and interactions within a community shall be open to individuals who live, work, or worship within counties defined as the Barren River Area Development District as established by KRS147A.05. In 2009, Service One utilized green building practices as prescribed by the U.S. Green Building Council's Leadership in Energy and Environmental Design (LEED) certification program. A few of the most innovative features of the Campbell Lane Branch include a living "Green Roof System" for added roof insulation, a Bioretention Basin that controls stormwater runoff, reclaimed wood timbers from a historic mill, which eliminated the need for a sprinkler system, and the first commercially-installed Nanogel-insulated windows. Service One was the first financial institution to utilize cash-recycling machines in 2009, which streamlined service and eliminated the need for cash drawers for its member service personnel.

In 2020, we added enhancements that will offer you the best in banking technology. Here are a few examples of the enhancement:

- Improved design for a simplified and more personalized online banking experience

- Enhanced security for credit and debit cards with real-time alerts for peace of mind

- Combined financial data from any institution to a single "financial dashboard" in your online "Home Branch"

- Improved mobile deposit functionality with automatic electronic endorsements

We are always evaluating ways to improve our credit union for our members.

What it means to be "Not-for-Profit"

Service One is committed to enabling our members to reach their financial goals.

As a credit union, we do not have shareholders, issue stock, or pay earnings dividends to outside stockholders. Instead, every member owns an equal stake in the institution, regardless of how much money they have on deposit. One of the ways a member can use this ownership is to vote for our Board of Directors. Our local Board of Directors, elected by the membership at the Annual Shareholders' Meeting, serves as unpaid volunteers and determines the credit union's direction.

Any profits Service One earns are returned to the membership in the form of better rates on loans and savings, lower fees, dividends, and improved services. Also, we are less likely to charge service fees than for-profit banks, and when we do charge, fees tend to be lower. In 1963, a group of local people at Western Kentucky University, Bowling Green, Kentucky, decided to help other people by starting a credit union and loaning them money at a lower rate than banks. Their philosophy of "People Helping People" created a solid foundation for a great credit union. Our Board of Directors and Supervisory Committee are all volunteers.

As a not-for-profit financial institution owned by our members, we give back to our members/owners with lower interest rates, great products, and higher dividends. Our associates volunteer for several events to benefit our community. We help support by sponsoring events for other organizations and by offering high school seniors and returning W.K.U. students scholarships.